Command Palette

Search for a command to run...

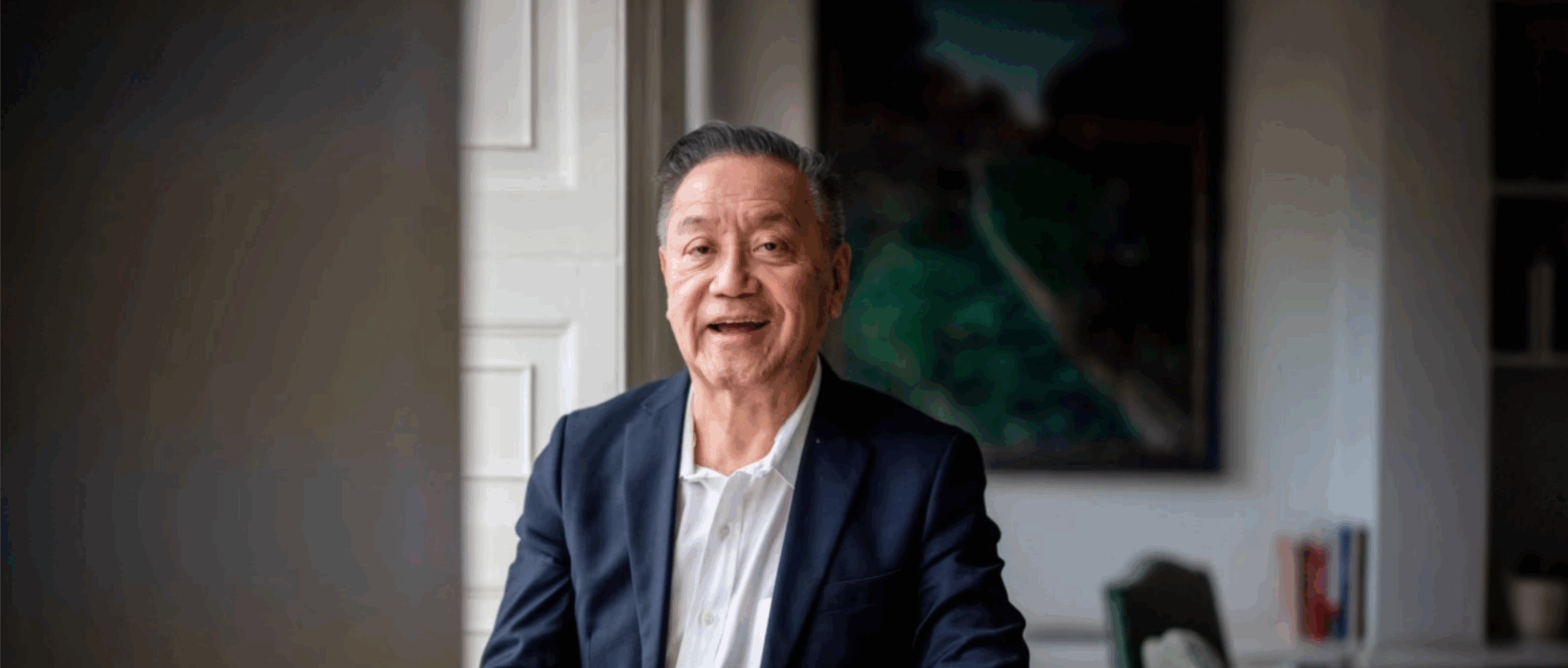

Broadcom's 72-year-old CEO, Who Built His Company on Acquisitions, Has Extended His Contract Until 2030, Aiming to Increase the company's AI Revenue to $120 billion.

In early November 2017, during Trump's previous term, the White House welcomed a unique CEO—unlike tech upstarts emphasizing technological visions or Wall Street investors chasing profit-driven trends, Broadcom CEO Hock Tan, who rarely appeared in the spotlight, was then over sixty years old.Standing in front of Trump, he announced in a high-profile manner that he would move the company headquarters from Singapore to the United States, settling in Silicon Valley.

While the outside world was still speculating why Hock Tan was supporting Trump's "bring jobs back to America" strategy, even more significant news emerged.Broadcom plans to acquire Qualcomm for hundreds of billions of dollars.Although the move to acquire this long-established American chip giant made people understand the move as a relocation of headquarters, Hock Tan's ambition and boldness still caused a huge sensation at the time: if this sky-high deal were to be successfully completed, it would not only create the largest merger and acquisition in semiconductor history, but also create a behemoth that dominates many chip fields.

After a four-month battle—Broadcom initially raised its offer to $121 billion, but was rejected and then turned to a hostile takeover demanding a board reshuffle; Qualcomm inflated its own value and secretly introduced regulatory scrutiny—this tug-of-war was ultimately halted in March 2018 by a ban issued by Trump, and Broadcom abandoned its acquisition. However, just four months later,Broadcom announced its acquisition of software giant CA Technologies for $18.9 billion.Instead of lingering over the semiconductor empire hidden within Qualcomm, Hock Tan embarked on a remarkable leap from pure semiconductors to infrastructure software.

These two acquisitions gradually brought the low-profile Hock Tan into the public eye. However, for those familiar with the semiconductor industry, this is precisely Hock Tan's consistent style: continuously expanding his territory through aggressive and efficient mergers and acquisitions. Reports indicate that he once described himself at the 2015 Chinese American Semiconductor Association's annual dinner in this way..."I'm not a semiconductor person, but I know how to make money and run a business."

Looking at Hock Tan's resume, "mergers and acquisitions" are an unavoidable topic. However, viewing him solely from a business investment perspective would be too narrow and simplistic. Each of his moves, beyond profit and revenue calculations, has gradually brought his company to a core position, with his underlying trend predictions being even more crucial. Now, nearly 20 years after taking over Avago, he has propelled Broadcom into the trillion-dollar market capitalization club and successfully bet on the AI wave, pioneering a gold rush path drastically different from Nvidia's.

A self-taught entrepreneur with a strong work ethic accelerates corporate restructuring and growth.

Hock Tan's career path is quite different from that of typical Silicon Valley tech leaders. He wasn't an engineer by training, nor did he start from the bottom in R&D at a tech company; instead, he began in traditional manufacturing and financial management.This experience later became a key foundation for his "operational efficiency as the core" approach in the semiconductor industry.

Born into a Malaysian Chinese family, Hock Tan received a scholarship to MIT at the age of 18 and went on to study mechanical engineering, earning both his bachelor's and master's degrees. In 1979, he went on to earn his MBA from Harvard University.

These two prestigious university experiences undoubtedly served as stepping stones to the start of his career.After graduating, he worked for a period in the finance departments of PepsiCo and General Motors. From 1983 to 1988, he returned to Malaysia and worked for cement manufacturer Hume Industries, before moving to Singapore to serve as managing director of venture capital firm Pacven Investment. He returned to the United States in 1992, where he was employed as vice president of finance at PC manufacturer Commodore International.

It's not hard to see that although Hock Tan held important positions in these experiences, he primarily worked in finance, far removed from cutting-edge technology.However, it helped him forge an extremely "practical" management methodology: high discipline, high efficiency, strong cash flow, and a strict profit model.More importantly, in these traditional industries, a company's competitive advantage does not rely on stories and visions, but on execution, cost structure, operational data, and return on assets.

His entry into the semiconductor industry occurred in 1994, after Commodore, mired in huge losses and declining sales, declared bankruptcy.41-year-old Hock Tan joined a chip company called Integrated Circuit Systems (ICS).He was promoted to CEO in 1999 and led the later restructuring of ICS.

In 2005, ICS merged with another mixed-signal chip manufacturer, Integrated Device Technology, for $1.7 billion. He became chairman of the merged company and gradually built it into a robust business with profit margins far exceeding the industry average. At that time, he already exhibited the style he later continued at Broadcom—Identify mature market segments, reduce business complexity, optimize cost structure, expand cash flow, and then concentrate resources on the most certain product lines.

It was precisely through this successful capital operation thatHe was recruited by private equity firms KKR and Silver Lake to become CEO of Avago Technologies.This company, which was originally spun off from HP's semiconductor business, became Hock Tan's new battleground to showcase his talent and courage. Perhaps it was only at this moment that he truly stepped into the core stage of the global semiconductor industry.

In 2006, when Hock Tan first arrived at Avago, the then-50-year-old faced a loss of $230 million in a single year. He then began a ruthless restructuring—Cut non-core businesses, sell off low-profit lines, integrate similar products, and improve gross profit and cash flow.

Its sweeping reforms included selling its storage business for approximately $420 million, its printer chip business for $245 million, and its image sensor business for $53 million. Besides generating cash,The company also reduced its workforce from 6,500 in 2005 to approximately 3,600 in 2008.He also set strict targets for the remaining departments: they must meet the gross profit margin target of 30%, otherwise they will still face closure or sale.

Relentless cost-cutting and strict financial targets led to Avago's return to profitability. By 2010, Avago's annual net profit had reached $420 million, and it successfully went public on NASDAQ in 2009.

Avago's turnaround is not only a highlight of Hock Tan's resume, but it also helped him understand factories, supply chains, IP, architecture, ecosystems, and industry cycles. He doesn't call himself a "tech-driven CEO," but he has built a semiconductor empire driven by financial discipline, industry integration, and supply chain efficiency.

Back in 2006, when Hock Tan first took the helm, former Avago president Dick Chang spoke highly of him."Hock Tan possesses exceptional leadership skills in driving company growth through sound strategic positioning and strategy implementation."He is the ideal person to lead Avago through a successful corporate transformation and continue its completely independent process.

A high-risk, high-reward strategy: breaking into the top ranks of the semiconductor industry through mergers and acquisitions.

Avago's turnaround IPO seems to have been just Hock Tan's first foray into business. When he discovered this approach still worked in the high-barrier-to-entry semiconductor industry, he launched a series of bold acquisitions, essentially "snake swallowing a elephant." It's noteworthy that this latecomer to the field wasn't just a financially savvy manager; rather, he resembled an investor adept at anticipating market trends. Each acquisition, seemingly a small-scale takeover, could be seen as a strategic move, and under his leadership, Broadcom's empire continued to expand.From a single chip business, it has expanded into storage networks, IT software, security, and cloud infrastructure software.Establish competitive moats in multiple key technology areas.

Rewinding to 2013, Hock Tan keenly recognized the enormous opportunities presented by the growth of data centers and mobile data traffic. He then set his sights on LSI Logic, a storage chip company with a broad ecosystem of enterprise storage customers. LSI Logic focused on enterprise-grade storage chips (SAS, RAID, HBA controllers), custom SoCs (ASICs), network processors, HDD controllers, and more. Combined with Avago's own expertise in fiber optic interconnects, LSI Logic was able to provide more comprehensive data center solutions.

final,He acquired the company, which had higher revenue than Avago, for $6.6 billion.However, he only used $1 billion of his own funds, with Silver Lake contributing $1 billion, and the remaining $4.6 billion being loans. Thus, a familiar scenario repeated itself: Hock Tan once again set out to cut costs and pay off debt. In May 2014, he sold LSI's flash memory solutions to Seagate for $450 million. Then, in November, he sold the network chip division to Intel for $650 million.

It can be said that he has become increasingly skilled in the "merger and acquisition-restructuring" strategy, which involves acquiring high-barrier product lines, stable cash flow businesses, and a strong market share through mergers and acquisitions.

Entering 2015, with the full rollout of 4G networks and a surge in smartphone shipments, the mobile internet boom has made switching chips, network controllers, Wi-Fi/Bluetooth, and broadband access chips the "infrastructure." Correspondingly, the semiconductor industry is also maturing, evolving towards modular, system-level solutions.

In response, Hock Tan recognized that the semiconductor industry was no longer driven by constantly launching new products, but rather by maturing technology. This necessitated a shift in business operations, focusing on the company's core "franchise"—a term he frequently used, which can be understood as the company's "flagship business." In his view, the company must establish and maintain its own franchise."When customers need a certain component, they instinctively think of you first," forming a small and stable local monopoly.

Based on this, his acquisition radar accurately detected Broadcom.

At the time, Broadcom's core businesses covered mobile and wireless communications, wired infrastructure, and other sectors in a highly mature and technologically advanced field, where the established giant also held a significant market share. Ultimately, Hock Tan completed this acquisition, which was then the largest in the semiconductor industry, for $37 billion. Avago was subsequently renamed Broadcom, transforming into a diversified semiconductor company encompassing wireless communications, storage, and network infrastructure development.It has jumped to fifth place globally (ahead of it are Intel, Samsung, TSMC and Qualcomm).

The rest of the story is well-documented and involves swift and decisive reforms. At the time, some outside observers commented that "this is a high-intensity surgical integration, but the result is often a significant increase in profits." Indeed, the merged Broadcom quickly entered a phase of accelerated revenue growth and a significant increase in net profit margin.

The fifth-place ranking globally was clearly not the end. In 2017, Qualcomm challenged for third place, but as mentioned at the beginning, industry analysts suggested that one reason the Trump administration halted the acquisition was concern that Qualcomm's 5G business competitiveness in China would diminish during the restructuring following the Broadcom acquisition. This "David and Goliath" acquisition strategy, in a sense, proved to be both a blessing and a curse.

In the following years, as the global semiconductor industry slowed down, Hock Tan shifted course, completing three large-scale software acquisitions: the $18.9 billion acquisition of CA Technologies in 2018; the $10.7 billion acquisition of Symantec's enterprise security business in 2019; and the record-breaking $61 billion acquisition of cloud computing software giant VMware in 2022.

"Broadcom started as a semiconductor company, and over the past six years, we've gradually transitioned into infrastructure software, and we've made very good progress," Hock Tan said in a September 2024 interview with CNBC host Jim Cramer. "The acquisition of VMware is essentially another step in that direction."The goal is to create a very balanced combination between enterprise-facing chip business and infrastructure software.

Looking back at Broadcom's development, from the perspective of the financial data that Hock Tan focuses on, this transformation has brought considerable benefits, helping the company improve its flexibility and competitiveness in the AI era.

Promoting Broadcom to the core of AI infrastructure

Looking back to 2025, in the wave of AI-driven infrastructure construction, thanks to Hock Tan's parallel strategy of chip and infrastructure software development, Broadcom has quietly become a key player, especially after reaching a long-term agreement with OpenAI, which has brought it to the main stage of AI on par with Nvidia.

Indeed, Hock Tan recognized the transformative impact of AI on the industry early on. At TSMC's 30th anniversary forum in 2017, he shared his perspective: "The industry will see entirely new vertical integration, and the influence of cloud service providers will permeate the entire industry. In this new semiconductor ecosystem..."Cloud service providers are the true masters. More importantly, they will ultimately design and manufacture their own chips.

Therefore, his strategy is not to confront Nvidia head-on, but to control the underlying network of computing power, namely custom ASICs (Application-Specific Integrated Circuits) and network interconnects.

Perhaps as early as 2013, when he acquired LSI, he began planning to "steal" market share from hardware manufacturers that specialized in general-purpose chips. At that time, he also acquired a small custom chip design division within the company, which had assisted external clients in producing their own chips for data centers. It wasn't until 2016 that Broadcom's custom ASIC business gained a major client—Google.

As is well known, Google's TPU is a core part of its strategy to break free from reliance on general-purpose GPUs and find more energy-efficient AI training and inference chips.Its internal team designed the TPU architecture, but the key partner that truly commercialized and scaled up these chips was Broadcom. Hock Tan also revealed that three major clients are actively developing new chips with him, and rumors suggest that in addition to Google, Meta and ByteDance are also involved.

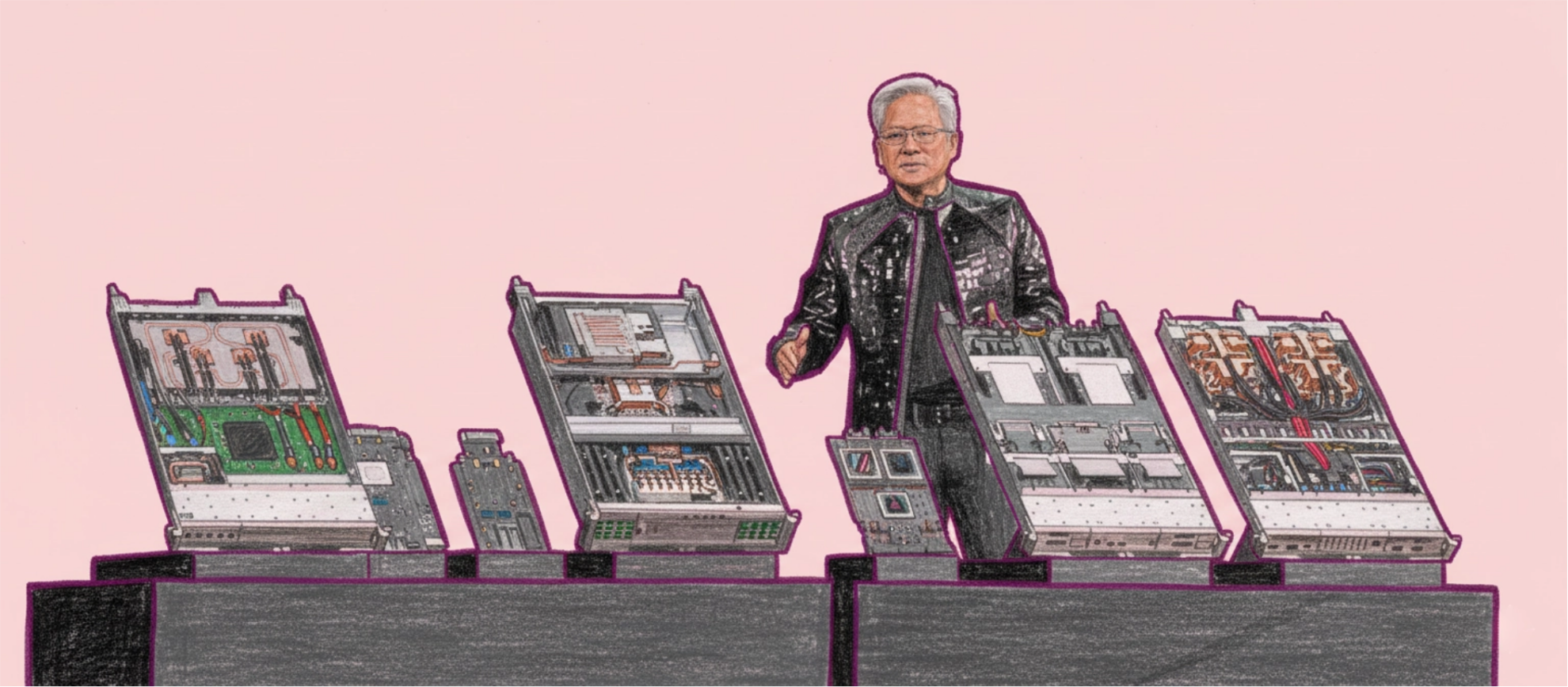

With Broadcom's frequent appearances in the AI field, the competition between ASICs and GPUs has gradually come to the forefront. Jensen Huang once asserted that..."Among numerous ASIC projects worldwide, the 90% will fail."He believes that compared to Nvidia's general-purpose GPU architecture, ASICs are designed for specific tasks, resulting in "high barriers to entry and high maintenance difficulty." While they offer extremely high performance and efficiency for a single purpose, they lack flexibility and scalability. This "single-point optimization" strategy is ill-suited to the rapidly evolving reality of AI applications.

This doesn't actually contradict Hock Tan's view—he predicts that customized ASIC chips will be primarily adopted by large cloud service providers.These giants have both the capability and the willingness to deeply customize chips for specific workloads (such as large language models) in pursuit of ultimate performance and cost-effectiveness.Enterprise customers will likely continue to use commercial GPUs.

At the Goldman Sachs Communicopia + Technology Conference 2025 in September, he, as the company's leader, shared the company's future plans in the AI field: meeting the AI computing needs of specific customers is the company's top priority, and it is expected that within the next two years, AI-related revenue will exceed the combined revenue from software and other non-AI businesses. Specifically,Its AI business revenue is projected to grow from $20 billion in 2025 to $120 billion in 2030.

Beyond GPUs, as AI model parameters become increasingly massive, training typically requires hundreds or even thousands of GPUs (or accelerators) to work together. This places extremely high demands on the internal network of data centers, making the underlying switch ASICs the "water and electricity network" of super data centers, with bandwidth, latency, and scalability being key bottlenecks.

Broadcom has two key product lines in this field:Tomahawk and Jericho represent high-performance AI training networks and large-scale cloud data center backbone networks, respectively.If Nvidia's GPUs are likened to engines, then Broadcom is paving the way for highways. Therefore, many industry insiders view Broadcom's bet on network interconnectivity as the safest and most practical part of its AI infrastructure strategy.

In addition, by acquiring VMware and combining its virtualization, cloud management, security and other related technologies with its own hardware capabilities, Broadcom is also able to build private cloud/hybrid cloud platforms.

Conclusion

Now over 70, Hock Tan appears in the media more frequently than before, and we can still clearly see that his style is very different from that of other big names like Jensen Huang, Elon Musk, and Sam Altman. Some have described him as having the introverted and shy nature typical of Chinese people, but his actions are undeniably radical and bold.

Not long ago, he announced that he had reached an agreement with the board to remain CEO "at least" until 2030. Given this period of explosive growth in AI infrastructure development, characterized by both high opportunities and intense competition, it remains to be seen whether his next five-year plan includes any acquisitions. Is there any other company that can fill the void left by Broadcom? Or, what business will he be developing for the company?

References:

1.https://www.asianometry.com/p/the-600-billion-ai-chip-giant

2.https://www.pingwest.com/a/264358

3.https://www.itiger.com/news/1114080513

4.https://www.ft.com/content/0a4013b6-b3b9-49fd-87a9-bd0da5e229b1